The term “US debt ceiling” might sound like political jargon, but it directly affects your life — from your savings to interest rates and even the economy’s stability. If you’ve ever wondered why Congress is always fighting over it, or why the U.S. keeps “running out of money,” this article breaks it down in plain English.

Understanding the US Debt Ceiling Explained

The debt ceiling is the legal limit on how much money the U.S. government can borrow to meet its existing obligations. Think of it like a credit card limit for the country. The U.S. Treasury needs to borrow money to cover spending already approved by Congress — such as Social Security, military salaries, Medicare, and interest on national debt.

How It Works

When the government spends more than it collects in taxes (which happens often), it borrows to make up the difference. Congress sets a cap — the “debt ceiling” — on how much total debt can be issued.

Once that ceiling is hit, the Treasury cannot borrow more money unless Congress votes to raise or suspend the limit. Without that approval, the government could default on its obligations — meaning it wouldn’t be able to pay its bills on time.

For example, according to the U.S. Treasury Department, the current national debt exceeds $34 trillion, and that number keeps rising due to ongoing deficits and spending commitments.

Why Does the U.S. Keep Hitting the Debt Ceiling?

It’s not that the government is careless with money — it’s that its expenses consistently exceed its income. Over time, borrowing becomes necessary to sustain operations and programs.

1. Persistent Federal Deficits

The U.S. spends more than it earns. Programs like Medicare, Social Security, and defense account for the majority of federal spending. Even when tax revenues grow, spending often grows faster.

Example: During the pandemic, massive stimulus packages helped millions of Americans but also added trillions to the national debt.

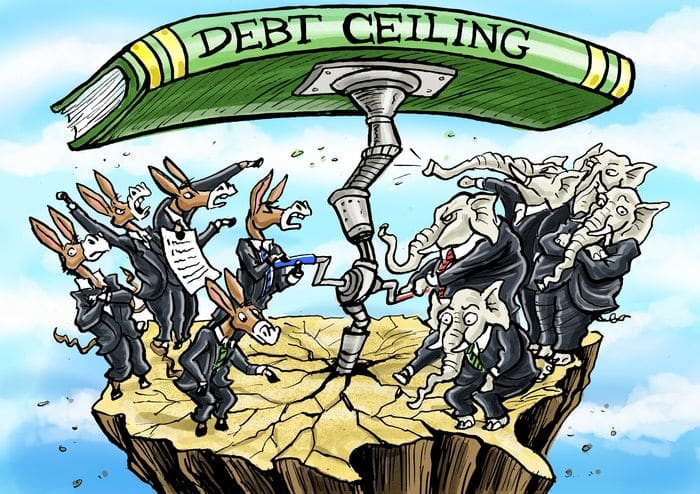

2. Political Gridlock

Each time the debt ceiling needs to be raised, it becomes a political battle. Some lawmakers use it as leverage to push for spending cuts, while others argue that refusing to raise it risks economic chaos.

In recent years, these standoffs have led to government shutdowns and even threats of U.S. credit downgrades, like in 2011 when Standard & Poor’s downgraded America’s credit rating for the first time. (Source: Bloomberg)

3. Rising Interest Costs

As national debt grows, so do the interest payments on that debt. The Federal Reserve has raised interest rates to fight inflation, but that also makes it more expensive for the government to borrow money. This creates a loop — higher debt leads to higher interest payments, which leads to even more borrowing.

What Happens When the Debt Ceiling Isn’t Raised?

If the debt ceiling isn’t raised or suspended, the Treasury has to rely on “extraordinary measures” — temporary accounting tricks to keep paying bills. But once those run out, the U.S. risks defaulting.

The Real-World Impact

- Delayed Payments: Social Security, veterans’ benefits, and federal salaries could be delayed.

- Stock Market Turmoil: Investors lose confidence, leading to market drops.

- Global Panic: Since the U.S. dollar is a global reserve currency, a default could shock the world economy.

Even the threat of default can rattle markets. In 2023, Congress narrowly avoided a crisis by passing a last-minute deal to suspend the limit.

A Brief History of the U.S. Debt Ceiling Explained

The concept dates back to 1917, when Congress created the debt limit during World War I to give the Treasury more flexibility to issue bonds.

Since then, the ceiling has been raised or suspended more than 100 times, under both Republican and Democratic presidents. It’s not a new problem — it’s a recurring feature of U.S. fiscal policy.

Key Milestones

- 1980s: The Reagan administration saw major tax cuts and defense spending, pushing debt higher.

- 2008: The Great Recession led to massive bailouts and stimulus packages.

- 2020: COVID-19 relief measures added over $5 trillion in new debt.

- 2023: Another political showdown over the debt ceiling was resolved just days before the U.S. was set to default.

How the Debt Ceiling Affects Ordinary Americans

You might wonder — what does this have to do with you? Quite a lot, actually.

1. Higher Borrowing Costs

If the U.S. defaults or even gets close to it, interest rates on things like mortgages, car loans, and credit cards can rise. Lenders demand higher rates when they perceive more risk in the system.

2. Market Volatility

Uncertainty around the debt ceiling can spook investors, leading to drops in 401(k) balances and retirement funds.

3. Economic Slowdown

If confidence in the government’s ability to pay bills falters, the ripple effect can slow down hiring, reduce investments, and even lead to job losses.

Why Not Just Eliminate the Debt Ceiling?

Many economists argue that the debt ceiling is outdated and unnecessary. It doesn’t control spending — it simply limits the government’s ability to pay for spending Congress has already approved.

Pros of Eliminating It

- Prevents recurring political crises.

- Reduces risk of default and market panic.

- Simplifies fiscal management.

Cons of Eliminating It

- Critics argue it removes a key accountability tool, allowing unchecked borrowing.

- Some lawmakers see it as an essential mechanism for fiscal discipline.

Even so, countries like Canada and the U.K. don’t have debt ceilings — their governments can borrow as needed, subject to parliamentary approval.

The Future of the U.S. Debt Ceiling

Experts predict that debates around the U.S. debt ceiling will continue for years to come. America’s aging population, rising healthcare costs, and defense budgets mean higher spending — and more borrowing.

Unless structural changes are made — like reforming taxes or entitlement programs — hitting the debt ceiling will remain a recurring challenge.

As Bloomberg noted, these recurring showdowns undermine confidence in U.S. fiscal stability and could one day impact the dollar’s dominance in global markets.

FAQs About the U.S. Debt Ceiling Explained

Q1: What is the U.S. debt ceiling in simple terms?

It’s the legal limit on how much money the U.S. government can borrow to pay its bills — like a national credit card limit.

Q2: Why does America keep hitting the debt ceiling?

Because government spending continually exceeds tax revenues. Over time, the gap forces more borrowing and pushes the nation closer to its debt cap.

Q3: What happens if the U.S. fails to raise the debt ceiling?

The government could default, leading to delayed payments, financial market chaos, and higher interest rates for consumers.

Final Thoughts

The U.S. debt ceiling explained simply: it’s a political and economic balancing act. While it’s meant to encourage fiscal responsibility, it often creates unnecessary crises that ripple through the economy.

Until Washington finds a long-term solution to manage spending and revenue, expect to keep hearing about this “ceiling” — again and again.